With another Christmas celebrated and already showing up on our waistlines, a common topic of conversation for many of us in January is our New Year resolutions.

Whether it’s a pledge to give up smoking, get to the gym more often, or start (yet another) healthy eating regime, New Year resolutions usually have a self-improvement or healthy living focus. But what about your finances? A healthy financial situation is just as important to your well-being as a healthy diet and exercise regime. Here are a few New Year resolution suggestions for your finances that could make a big difference to your financial health in 2017 and beyond. If one of these appeals to you, please give us a call as we’d love to help you achieve your financial New Year resolutions this year.

“I will make a proper budget and stick to it.”

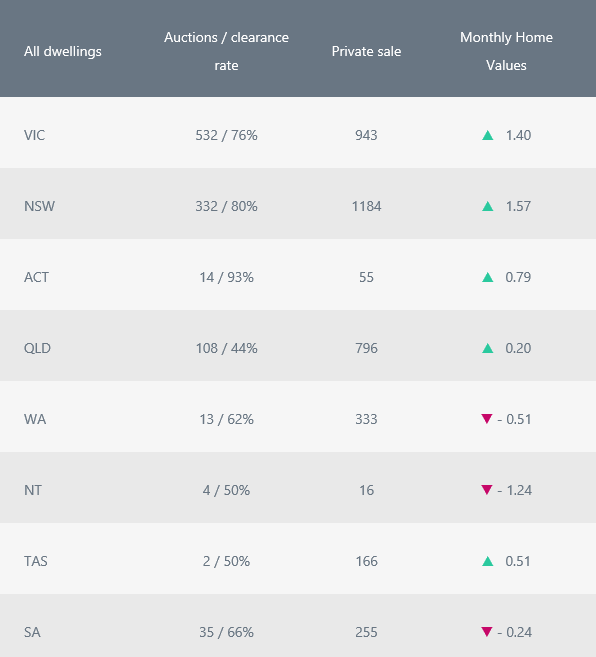

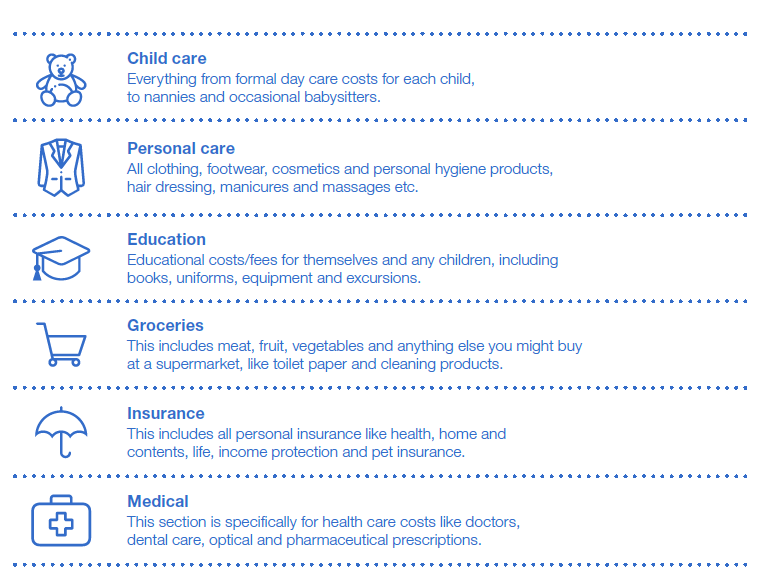

Did your credit card debt go up or down in 2016? Spending more than you earn is surprisingly easy to do and having to pay exorbitant credit card interest on all of your purchases just makes matters worse. The secret to turning this situation around is to create a proper budget for yourself and stick to it. It’s also a good idea to include repayments on your credit card as a weekly expense in your budget outgoings, so you can work on getting your debts paid off as well.

To create a realistic budget, list all of the things you need to spend money on and how much they cost. The amount you have left over each week is the amount you can afford to spend on the things you want, put into your savings account, or use to pay off your debts sooner. It’s also important to review your budget regularly to see how you are tracking.

If you have multiple credit card debts, or a variety of debts, you may find managing your budget a challenge as a large part of your income may be lost on interest payments. This kind of situation is frequently referred to as a ‘debt trap’. Talk to us about consolidating your debts to reduce your interest payments and make your financial situation more manageable.

“I will make an effort to achieve my saving goals.”

The ability to save money consistently is a talent that everyone should cultivate. It’s particularly important if you’re saving a deposit for your first home, as a lender will take your savings history into consideration when deciding if you are eligible for a home loan.

If you are the kind of person who finds it hard to stick to a budget, can’t resist impulse purchases, or indulges in ‘retail therapy’, then you may like to consider installing an app on your mobile phone that supports your efforts to save. ASIC’s MoneySmart website offers a variety of excellent free apps designed to help you manage your finances:

- TrackMyGOALS integrates techniques that are proven to work for successful savers.

- TrackMySPEND helps you see where your money is really going so you can adjust your spending habits to save more. Even just committing to reducing the number of take away coffees you buy each week can make a big difference over a full year!

“I will stop wasting my money on rent.”

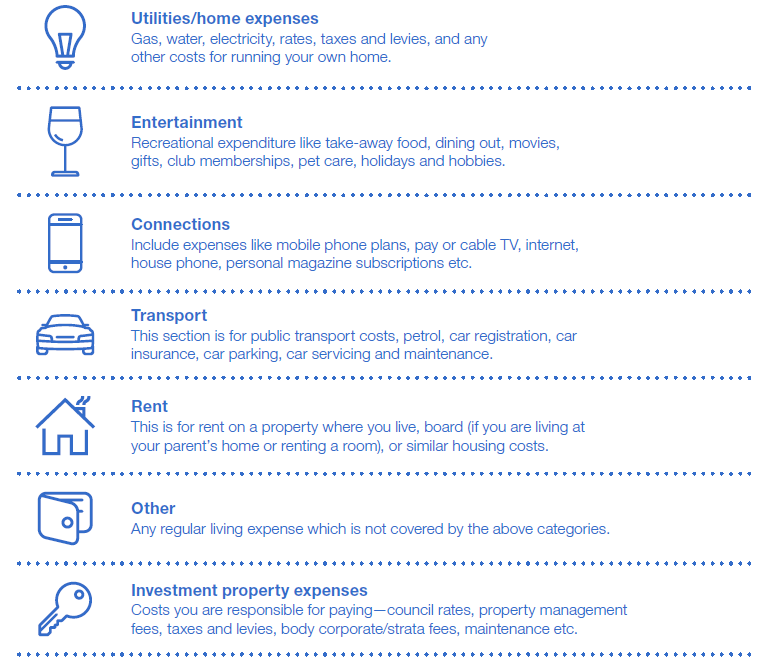

For many people, choosing to rent a property instead of buying one boils down to a lifestyle choice. It may be more affordable to rent a property in a location where you enjoy living, than it is to buy one. But the consequence of this choice is that when property prices rise, you are potentially missing out on some significant capital gains that could be important to your financial well-being later on in life.

What’s more, the money you spend on rent is wasted – you are potentially paying off someone else’s investment when you could be paying off a property of your own. So the question is: do you have enough money for a deposit?

If you have been saving regularly and have some money in the bank, now is a great time to take stock of what kind of property you may be able to afford this year. Just give us a call and we’ll be happy to sit down with you and help you work it out!

Getting on the property ladder may mean that you have to consider a location where you can afford to buy, rather than a location where you prefer to live. It may mean giving up your short commute home from work, or easy access to your friends and family, favourite bars, shopping venues and cinemas. But with property prices rising steadily, the long-term benefits could have a significant impact on your future financial security and retirement lifestyle, so it could be worth it to act now.

“I will review all of my financial accounts, including my home loan”

When was the last time you stopped to think about how much money you are paying on fees every year for your mortgage, bank accounts, credit cards and superannuation plans? Most people would be horrified to discover exactly how much money they lose every year in fees and charges across their financial accounts – so it definitely pays to review them regularly and cancel any unnecessary accounts you hardly ever use and don’t really need.

For example, the fees and charges you pay on your superannuation accounts can be quite high and they often go unnoticed. Over the years, these fees and charges may add up to make a big difference to the balance of your super on retirement. The fact is, if you have more than one superannuation account, you are paying double the fees you need to pay! Consider consolidating all your super accounts into one as soon as you can.

The same rule applies to your credit cards. How many do you really need? What are you using them for? If you have more than one, it may be a good idea to transfer all of the balances to one card using a free balance transfer offer. This not only has the potential to save you a significant amount of money on fees, it could also save you some money on interest and perhaps, help you to pay off your credit card balances sooner. Don’t be tempted to keep all of the old cards though, remember to cancel them as soon as you make the balance transfer.

If you have a mortgage, now is a good time to look at which features and benefits it provides, and if you are using them. Do you really need them? Is your home loan the most suitable for your current financial goals? If not, talk to us so we can see if you could be saving on fees, getting a more favourable interest rate or accessing the loan features you need!

We can help you achieve your financial New Year resolutions

Our role as your mortgage broker is to help you arrange your credit and finance to maximise the money you have. We’re here to help you save on interest wherever possible. Whether it’s time for a home-loan-health check on your existing mortgage, or you would like to find out how much you can afford to spend on buying a property, you’ll find our expertise and support invaluable in helping you to achieve your goals. We are even willing to help you find better ways to manage your debt and plan to build wealth for your future.

Financial success means setting some financial goals and making a step-by-step plan to reach them. With a credit and finance professional on your team, you are much more likely to get where you want to be. If you would like to buy a property in 2017, then we can help you achieve your goal by assisting with everything from setting your purchasing budget and getting pre-approval on your home loan, to supplying you with insightful property market data so you can locate the right home to buy more quickly.

Make sure your New Year is a happy one by talking to us about getting on top of your finances. It is one New Year resolution you’ll find very easy to keep! Call us to make a time today.