Welcome to our September Newsletter

Spring has arrived and we are supercharged for a bumper season in the property world. Dwelling values have been creeping up in many markets and auction clearance rates have been higher recently too. Interest rate reductions and changed lending rules have fuelled increased buyer activity, though stock volumes remain low. Overall, the housing recovery looks set to continue.

Interest rate news

At its September meeting, the Reserve Bank of Australia (RBA) decided to leave the official cash rate on hold at 1% pa. The move follows rate cuts in June and July.

While this month’s decision was widely anticipated, economists say there could be more cuts by the end of the year, potentially starting in October. Recently we’ve seen some lenders slash fixed interest rates on both owner-occupier and investor loans.

Given rates are on the move, now is the time to review your finance. It may even be worth considering fixing your home loan – speak to us about your options!

Home value movements

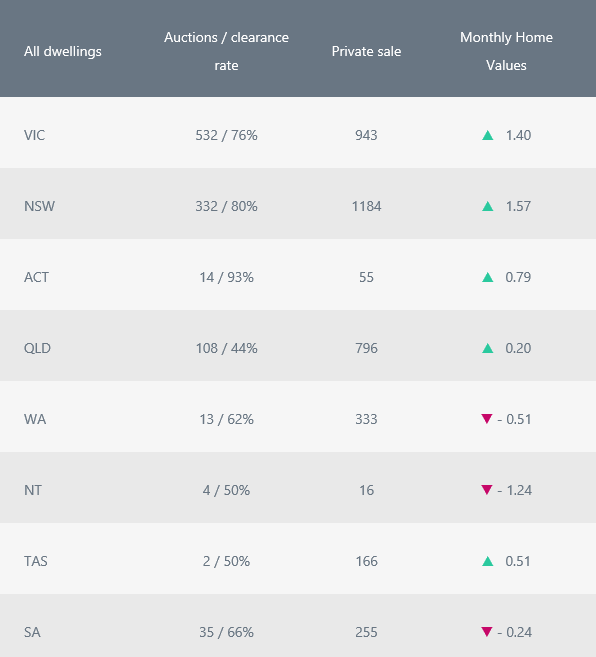

Property prices are continuing to rise, up 1.03% across the combined 5 capital cities in August. Prices in Sydney and Melbourne continue to trend higher. Sydney recorded a month-on-month change of 1.57%, while Melbourne’s property values grew by 1.40%. In Canberra, prices increased by 0.79%, while in Hobart they rose by 0.51%. Brisbane saw modest growth (0.2%), while Perth and Adelaide experienced falls of 0.51% and 0.24% respectively.

In recent weeks, we’ve seen auction clearance rates soar in many markets. In fact, auctions across Australia’s capital cities reached a two-year high in August.

Property market activity

Ready for a spring property purchase?

If you’re considering buying this spring, speak to us about organising your finance. Given that stock volumes are low, there’s bound to be strong competition amongst buyers, but having pre-approval in place may give you a competitive edge. Get in touch today so we can get it sorted!

There are no comments yet, but you can be the first