There’s no doubt about it – buying your first home is one of the most rewarding experiences of your life! However, it is an emotional journey. Here are 6 feelings you may experience as part of the purchasing roller coaster (buckle your seatbelts – it’s quite a ride!).

1) Excitement at the prospect of buying

You’ve been working hard to save a deposit and it’s finally time to purchase. When that time comes, it’s like someone has opened the door to a whole new world. And it’s an exciting place indeed! At this point, the anticipation is killing you.

2) Confusion about what exactly is involved

You’re a rookie, so of course the purchasing process can seem overwhelming and daunting. Where does one start? What kind of research is required? What type of loan is right for your needs?

Here’s a quick rundown of the steps involved:

1. Apply for pre-approval

2. Do your research and find the right home

3. Have your conveyancer check the contract of sale

4. Organise building and pest inspections

5. Put in an offer or go to auction

6. Finalise your home loan

7. Do a final inspection on the property

8. Settlement

9. Move in!

3) Relief when you discover how we can help

Ahhh, you’re not in this alone. That’s right – we can walk you through the buying process, starting with the research component. Our free suburb and property reports offer a wealth of information, from details about capital growth and median values, to recent sales data.

Next, we’ll take care of your finance for you. We can:

- Explain your borrowing capacity (how much a bank will lend you)

- Arrange pre-approval on your finance (so that you’re ready to make offers or bid at auction)

- Explain loan features that may save you money in interest (for example offset accounts and redraw facilities)

- Line you up with the right home loan for your specific needs

- Take care of the paperwork for you.

4) Exasperation as you look for the right property

If you’re one of the lucky ones who finds the right property early, you may escape the exasperation stage altogether. However, if you find your weekends being consumed by inspection after inspection to no avail, it can leave you feeling exhausted and discouraged.

Don’t despair – your dream home is out there. Just remember, with every inspection you’re one step closer to the thrill of finding your very own pad!

5) Nervy during negotiations

You know when you’re at the top of the roller coaster incline and it’s about to drop? Waiting for a vendor to accept your offer or fronting up at an auction can feel a bit like that. There are bound to be butterflies in your stomach – just hold on tight and remember the best is yet to come.

6) Elation when the paperwork is signed and it’s yours!

There’s nothing as rewarding as receiving a shiny new set of keys and walking through the front door into your own slice of real estate. You’ve survived the journey and probably even enjoyed it! It’s at this point you’ll feel pure, unadulterated joy.

Buying your first home is an experience you’ll never forget. The thrill. The adrenalin. And the rush of emotions when it’s finally yours are hard to beat. If you’re ready to purchase your first home, please get in touch. Let us be your conductor; you just enjoy the ride.

02 Oct 2019

4 habits of successful property investors

Australians love investing in property, and it’s no wonder why. The property market offers a myriad of opportunities to potentially grow wealth, irrespective of one’s professional background or skillset.

However, there are certain habits that successful property investors often have in common. Let’s take a look.

They are proactive about self-education

In order to stay ahead of the game, seasoned property investors are proactive about self-education. They understand that the property market is ever-changing, and that one must keep up to speed with developments in order to succeed.

As a result, successful investors understand the economic factors that drive markets and the way market cycles work. They can recognise when the market is shifting and act early. And they can seize opportunities where possible.

If you want to be a successful investor, you need to become an avid learner. Here are some ideas:

- Listen to podcasts

- Devour books, investment magazines, and blogs on the topic

- Do property investment courses online or through a local learning institution.

They make the most of professional help available to them

Smart property investors understand that while it’s important to nurture their own knowledge, they can’t know everything. Everyone has limits.

The key to success is to leverage the abilities of exerts in their field. Mortgage brokers, real estate agents, financial planners, accountants, conveyancers, buyers’ agents, property managers – all of these professionals are resources to be drawn on in order to make smart property investment decisions.

They review their investment loans regularly

The right investment loan for you today may no longer suit your needs in a year’s time. Successful property investors continually review their loans to make sure they still measure up.

In this way, clever investors can identify new opportunities along the way. For example, they may refinance their loans to include offset accounts and redraw facilities to save interest, or they may set up lines of credit to renovate their investments.

They have vision

Experienced property investors look past the current market movements to see the big picture. They understand the nature of property cycles. Sometimes it pays to buy and hold property; other times it’s best to flip. Having vision is what sets the successful investor apart from the mediocre one.

They also plan for contingencies. Buying an investment property comes with financial benefits, but there is risk involved. For example, what happens if the tenant falls behind in rent or something major needs to be repaired? What if the property’s value falls? Smart investors plan ahead and have strategies in place for these kinds of challenges.

Like to know more?

Whether you’re a seasoned property investor with a multi-property portfolio or a rookie investor, we can help you achieve your financial goals. We’ll line you up with the right finance for your specific needs and future aspirations. Please get in touch.

23 Sep 2019

Welcome to our September Newsletter

Spring has arrived and we are supercharged for a bumper season in the property world. Dwelling values have been creeping up in many markets and auction clearance rates have been higher recently too. Interest rate reductions and changed lending rules have fuelled increased buyer activity, though stock volumes remain low. Overall, the housing recovery looks set to continue.

Interest rate news

At its September meeting, the Reserve Bank of Australia (RBA) decided to leave the official cash rate on hold at 1% pa. The move follows rate cuts in June and July.

While this month’s decision was widely anticipated, economists say there could be more cuts by the end of the year, potentially starting in October. Recently we’ve seen some lenders slash fixed interest rates on both owner-occupier and investor loans.

Given rates are on the move, now is the time to review your finance. It may even be worth considering fixing your home loan – speak to us about your options!

Home value movements

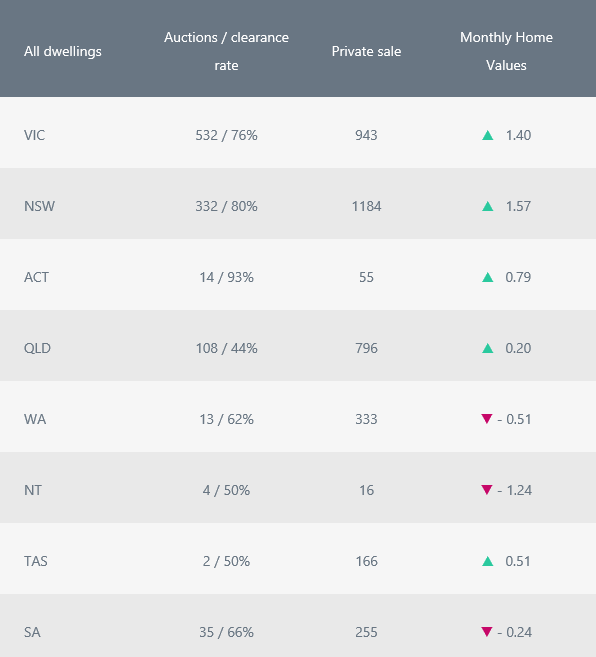

Property prices are continuing to rise, up 1.03% across the combined 5 capital cities in August. Prices in Sydney and Melbourne continue to trend higher. Sydney recorded a month-on-month change of 1.57%, while Melbourne’s property values grew by 1.40%. In Canberra, prices increased by 0.79%, while in Hobart they rose by 0.51%. Brisbane saw modest growth (0.2%), while Perth and Adelaide experienced falls of 0.51% and 0.24% respectively.

In recent weeks, we’ve seen auction clearance rates soar in many markets. In fact, auctions across Australia’s capital cities reached a two-year high in August.

Property market activity

Ready for a spring property purchase?

If you’re considering buying this spring, speak to us about organising your finance. Given that stock volumes are low, there’s bound to be strong competition amongst buyers, but having pre-approval in place may give you a competitive edge. Get in touch today so we can get it sorted!

04 Sep 2019

Four signs it may be time to refinance

Do you know what happened after the Reserve Bank cut the cash rate in June? Tens of thousands of Aussies took the Treasurer’s advice to “shop around and get the best possible deal”. Mortgage brokers around the country have recorded spikes in their home loan, investment loan and refinance borrower enquiries following the announcement.

The moral of the story? Now is the time to review your home loan. Here are four signs you may be overdue for a check-up.

You’ve been with the same lender forever

Interest rates are at historic lows and competition between lenders is high. That means there are plenty of red-hot deals out there, particularly given the recent cash rate cuts.

If you’ve been with the same lender for years, chances are you’re probably missing out on a better deal elsewhere.

You have no idea what a redraw facility or offset account is

Most home loans nowadays come with money-saving features like offset accounts and redraw facilities. These tools allow you to save in interest and potentially pay off your loan sooner.

How they work

Offset accounts

With this set up, a transaction account is linked to your mortgage. Any money deposited is offset against your loan balance, reducing your interest payable. Example: you owe the bank $400,000 and you have $50,000 in the offset account. Interest will only be calculated on $350,000.

Redraw facility

With this loan feature, you can make extra repayments on your mortgage and save on interest. Best of all, you can still access the funds in future should you need them.

Your personal circumstances have changed

What’s changed since you took out your mortgage? Are you earning more money? Have your living expenses changed? Do you have different financial goals?

All of these elements need to be taken into consideration when choosing the right home loan for your needs.

You’re drowning in debt payments

If you’re struggling to cover multiple debt repayments, debt consolidation could be the answer. This strategy involves refinancing your mortgage and using some of your equity to pay off the other debt.

The benefits are:

- Home loan interest rates are lower than other types of credit

- You’ll only have one repayment to meet

- You can spread the repayments out, so that they’re more affordable

- You may be able to make additional repayments and knock off your debt sooner.

While debt consolidation is not right for everyone (in some instances, you may end up paying more in interest over the course of the loan), it’s at least worth investigating.

Like to know more?

If the alarm bells are ringing, we can review your home loan and outline whether it’s still right for you. You may be better off with another loan that ties in with your current financial situation and goals. Please reach out – you have nothing to lose and everything to gain.

The busy Spring property season is just around the corner and you know what that means? Whether you’re planning to buy or sell, NOW is the time to start getting organised. Here’s how.

Tips if you’re planning to BUY this Spring:

Get your finance sorted pronto

There’s no point starting the property hunt until you know how much you can borrow. Talk to us and we’ll explain your borrowing power.

If you haven’t already done so, it’s also a good idea to get pre-approved for finance now, so that you don’t miss out on your dream home once you find it. For most lenders, pre-approvals last 3-6 months.

Do your research

Whether you’re a first home buyer or you’ve been around the block, it’s important to do your homework.

- Narrow down the suburbs you’re interested in and research the market value of your desired property type

- Check government websites for projects that may influence the capital growth potential

- Consider the zoning and whether upcoming developments could affect supply and demand

- Check out recent comparable sales on websites like realestate.com.au

- Get to know local real estate agents now, so that they keep you in the loop about new listings during Spring

- Ask us for a free suburb report with all the key info you’ll need.

Attend several auctions before you actually bid

Bidding at auction can be extremely daunting, particularly with the knowledge that there’s no cooling off period. You’ll want to feel confident about the process before going in guns blazing.

Over the coming weeks, make time to attend several auctions to get a feel for how they unfold. Even if you’ve bought at auction before, it’s a good idea to suss out the market in advance.

Tips if you’re planning to SELL this Spring:

Declutter

That’s right, it’s time to channel your inner Marie Kondo (she’s a tidying expert, if you haven’t heard of her). You may be thinking, ‘it’s only August, I’ll have time for that later,’ but it’s important not to underestimate how long the decluttering process can take!

Decluttering can make a world of difference to prospective buyers. It allows them to see the space more clearly and imagine themselves living in your home. In simple terms, space sells.

With that in mind, ditch what you don’t need and consider putting the majority of your belongings into storage.

Clean meticulously

Time to give your home a thorough clean. You’ll want your property looking its absolute best for when the inspections begin.

If there are any repairs or maintenance jobs you’ve been putting off over the Winter, now is the time to address them.

Consider renovating

Want to drive up the sales price? Why not renovate this month and add value to your property?

Most experts recommend the top priorities when renovating for profit should be the kitchen and bathroom(s). If you need finance for these kinds of big-ticket renovations, we can help.

However, even making small cosmetic enhancements, like applying a fresh coat of paint or putting up new blinds, could result in a heftier price tag.

Sort out your finance for your next property purchase

Already found your next home? You may need bridging finance to tide you over until settlement is finalised on your old property.

So, what’s on your to-do list this month? Remember, whether you’re buying or selling this Spring, now is the time to start planning and preparing. Speak to us for all your finance needs today!