The Reserve Bank of Australia (RBA) has announced an increase to their cash rate. So, it’s a good idea to plan for a higher rate environment and think of ways you can lessen any impacts on your budget. To help you make the most of the situation, we’ve put together this guide that includes an overview of rate rises and ways you can prepare.

What are rate rises, and what do they mean for you?

The RBA sets cash rates to sustain inflation. These rates are increased to curb spending and lowered to stimulate spending. Currently, economists forecast that there could be multiple rate increases over the coming years beyond this initial rise, given the last increase was in 2010.

But what does this mean for you? Essentially, the interest on your loans is likely to go up. But there are ways you can plan for this and reduce the impact of rises on your goals and lifestyle. To start, you should visit a repayment calculator and run some numbers to see how an interest rate increase will change your loan and whether you need to adjust your budget.

Review your budget

Speaking of budgets, you should review what you have in place! And if you don’t have one, now is a good time to start. Review your monthly surplus. Can you make higher repayments or cut out some costs? Running through these scenarios will help you stay on top of your finances.

Look into additional repayments

Making additional repayments is a great way to reduce your home loan if your budget allows. The more you reduce your principal, the less time it may take to pay off your home loan. To understand what additional repayments can do for you, check out an additional repayments calculator.

Look into a fixed loan

A fixed rate home loan gives you the comfort of knowing what your repayments will be over a specific period, making your goals and plans more manageable. One thing to be aware of is the end date of your fixed loan and any potential increase in interest based on the economic conditions at that time.

If you are looking to move to a fixed rate, you can do so with confidence by locking in an interest rate with a rate lock service. For example, our rate lock is applicable for up to 100 days from the request date, so that you can protect yourself from any potential rate increases.

Or try a split loan

Want the best of both worlds? Why not split your loan into a variable and fixed portion. You’ll get the security of a fixed rate for a part of your loan and all the benefits and flexibility of a variable rate for the other portion.

Make the most of flexible features

Offset accounts are a solid option if you’re looking for some flexibility. Every dollar you keep in your offset account reduces the interest you’ll have to pay on your linked home loan. This has the benefit of allowing you to use your offset funds when you need them.

Remember, Element Finance is here to help. You can call or message us today to understand the options available to you.

25 Feb 2022

What’s going on with interest rates??

HOLD ONTO YOUR HATS, THINGS ARE ABOUT TO GET A LITTLE BUMPY. ECONOMISTS FROM AUSTRALIA’S BIGGEST BANK ARE PREDICTING THE RESERVE BANK WILL RAISE THE OFFICIAL CASH RATE AS EARLY AS JUNE- AND WE’RE ALREADY SEEING FIXED INTEREST RATES INCREASE SIGNIFICANTLY.

Commonwealth Bank (CBA) economists have brought forward their forecasted Reserve Bank of Australia (RBA) cash rate hike from August to June, making it the earliest prediction amongst the big four banks.

We’ll go into more detail on why CBA has brought forward their prediction below, but first something a little more concrete: we’ve definitely noticed fixed rates trending up in recent months.

Fixed rate hikes

For example, back in November, for a $700,000 loan at 80% loan-to-value ratio, a two-year fixed rate with one particular lender was 1.84%.

That rate has since gone up to 3.04% – a staggering increase.

While not every lender has increased fixed rates so significantly, we are seeing them go up across the board.

So if you have been umming and ahhing about fixing your rate lately, you’ll want to get in touch with us sooner rather than later.

Because while most lenders have recently reduced their variable rates to compensate a little, with news now that the cash rate is being tipped to increase mid-year, you can expect variable rates to increase with the cash rate.

So why has CBA brought forward their forecast to June?

Ok, so back to CBA’s June cash-rate hike prediction and why they’ve brought it forward from August.

In a nutshell, CBA senior economist Gareth Aird is anticipating inflation to be a lot stronger than the RBA is forecasting.

As a result, Mr Aird believes this will lead to a rise in the cash rate to 0.25% at the June board meeting (currently it’s at a record-low 0.1%).

“We are very comfortable with our expectation that the quarter-one 2022 underlying inflation data will be a lot stronger than the RBA’s forecast,” explains Mr Aird.

And here’s the thing: it’s not the only cash rate hike CBA is predicting the RBA will make over the next 12 months.

Mr Aird is expecting a further three rate increases over 2022 to take the cash rate to 1%, with another move to 1.25% in early 2023.

That’s five cash rate hikes over 12 months!

Get in touch today to explore your options

Believe it or not, there are more than 1 million mortgage holders out there who have never experienced a rate rise (the last RBA cash rate hike was in November 2010).

And if the CBA’s prediction of five rate hikes over the next 12 months proves right, then some households will be in for a bumpy ride as they face hundreds of dollars in extra mortgage repayments each month.

So if you’re keen to act before the RBA increases the official cash rate, get in touch with me today. I would love to chat with you and help you work through your options in advance.

There’s no doubt about it – buying your first home is one of the most rewarding experiences of your life! However, it is an emotional journey. Here are 6 feelings you may experience as part of the purchasing roller coaster (buckle your seatbelts – it’s quite a ride!).

1) Excitement at the prospect of buying

You’ve been working hard to save a deposit and it’s finally time to purchase. When that time comes, it’s like someone has opened the door to a whole new world. And it’s an exciting place indeed! At this point, the anticipation is killing you.

2) Confusion about what exactly is involved

You’re a rookie, so of course the purchasing process can seem overwhelming and daunting. Where does one start? What kind of research is required? What type of loan is right for your needs?

Here’s a quick rundown of the steps involved:

1. Apply for pre-approval

2. Do your research and find the right home

3. Have your conveyancer check the contract of sale

4. Organise building and pest inspections

5. Put in an offer or go to auction

6. Finalise your home loan

7. Do a final inspection on the property

8. Settlement

9. Move in!

3) Relief when you discover how we can help

Ahhh, you’re not in this alone. That’s right – we can walk you through the buying process, starting with the research component. Our free suburb and property reports offer a wealth of information, from details about capital growth and median values, to recent sales data.

Next, we’ll take care of your finance for you. We can:

- Explain your borrowing capacity (how much a bank will lend you)

- Arrange pre-approval on your finance (so that you’re ready to make offers or bid at auction)

- Explain loan features that may save you money in interest (for example offset accounts and redraw facilities)

- Line you up with the right home loan for your specific needs

- Take care of the paperwork for you.

4) Exasperation as you look for the right property

If you’re one of the lucky ones who finds the right property early, you may escape the exasperation stage altogether. However, if you find your weekends being consumed by inspection after inspection to no avail, it can leave you feeling exhausted and discouraged.

Don’t despair – your dream home is out there. Just remember, with every inspection you’re one step closer to the thrill of finding your very own pad!

5) Nervy during negotiations

You know when you’re at the top of the roller coaster incline and it’s about to drop? Waiting for a vendor to accept your offer or fronting up at an auction can feel a bit like that. There are bound to be butterflies in your stomach – just hold on tight and remember the best is yet to come.

6) Elation when the paperwork is signed and it’s yours!

There’s nothing as rewarding as receiving a shiny new set of keys and walking through the front door into your own slice of real estate. You’ve survived the journey and probably even enjoyed it! It’s at this point you’ll feel pure, unadulterated joy.

Buying your first home is an experience you’ll never forget. The thrill. The adrenalin. And the rush of emotions when it’s finally yours are hard to beat. If you’re ready to purchase your first home, please get in touch. Let us be your conductor; you just enjoy the ride.

23 Sep 2019

Welcome to our September Newsletter

Spring has arrived and we are supercharged for a bumper season in the property world. Dwelling values have been creeping up in many markets and auction clearance rates have been higher recently too. Interest rate reductions and changed lending rules have fuelled increased buyer activity, though stock volumes remain low. Overall, the housing recovery looks set to continue.

Interest rate news

At its September meeting, the Reserve Bank of Australia (RBA) decided to leave the official cash rate on hold at 1% pa. The move follows rate cuts in June and July.

While this month’s decision was widely anticipated, economists say there could be more cuts by the end of the year, potentially starting in October. Recently we’ve seen some lenders slash fixed interest rates on both owner-occupier and investor loans.

Given rates are on the move, now is the time to review your finance. It may even be worth considering fixing your home loan – speak to us about your options!

Home value movements

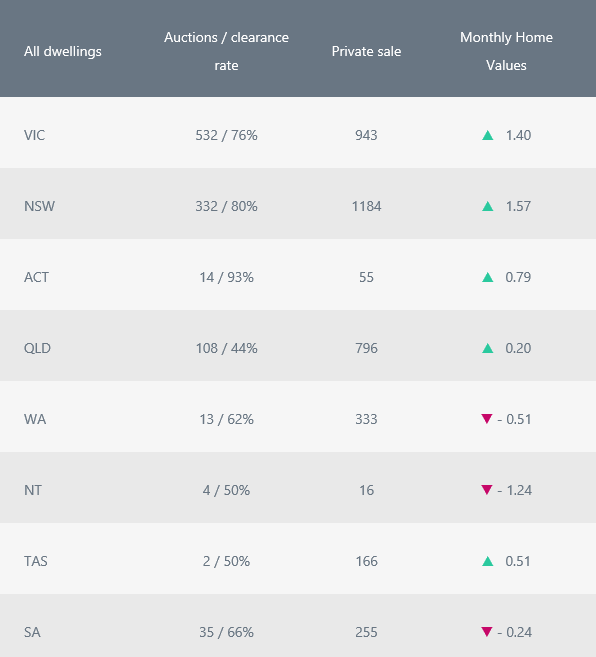

Property prices are continuing to rise, up 1.03% across the combined 5 capital cities in August. Prices in Sydney and Melbourne continue to trend higher. Sydney recorded a month-on-month change of 1.57%, while Melbourne’s property values grew by 1.40%. In Canberra, prices increased by 0.79%, while in Hobart they rose by 0.51%. Brisbane saw modest growth (0.2%), while Perth and Adelaide experienced falls of 0.51% and 0.24% respectively.

In recent weeks, we’ve seen auction clearance rates soar in many markets. In fact, auctions across Australia’s capital cities reached a two-year high in August.

Property market activity

Ready for a spring property purchase?

If you’re considering buying this spring, speak to us about organising your finance. Given that stock volumes are low, there’s bound to be strong competition amongst buyers, but having pre-approval in place may give you a competitive edge. Get in touch today so we can get it sorted!

24 Jan 2019

How to achieve your property goals in 2019

How are your New Year Resolutions coming along? If you’re serious about achieving the goals you’ve set for yourself, creating a plan is the way to go. Of course, making a plan is easy when you’re talking about losing weight or exercising more (the world’s most popular choices for NY Resolutions every year), but achieving your property goals may take some professional support from your mortgage broker. Here’s how we can help.

NY Resolution #1: “I’m going to buy my first home in 2019!”

Buying your first home is exciting and 2019 could be the year to do it. Home values have ceased their rapid rise for the time being and home loan interest rates are still low.

Here’s how your broker can help you get on the property ladder for the first time:

Creating a budget for your purchase and a savings plan for your deposit.

Exploring alternative ideas for a deposit (like a guarantor’s home loan, for example).

Providing advice about clearing debt and/ or improving your credit report to make you a more attractive prospect for lenders.

Explaining your borrowing capacity (how much you can afford to repay and how much a lender will lend you based on your income and expenses).

Going through any grants, concessions or other initiatives like the First Home Super Saver (FHSS) scheme to get you into your own home sooner.

Explaining the different types of home loans and how you can use them to save money.

Comparing the market to help you find the most suitable home loan for your needs.

Referring you to reputable professionals such as valuators, conveyancers and solicitors, accountants etc.

Organising pre-approval on your home loan so you know how much you can spend and save time on your property search.

Overseeing all the loan application paperwork.

Offering support throughout your entire home ownership journey and beyond. We can answer your questions at any time to ensure your home loan remains competitive.

NY Resolution #2: “I’m going to move into my next home in 2019!”

Upsizing, downsizing, sea-change, tree-change – whatever your motivation for moving into your next home in 2019, just ask us to help you make it happen! Even if you already know the drill for purchasing a home, it’s worth having a professional on your team when buying your next place. There’s a lot more to consider. Ask us about:

Using the equity in your current home as a deposit for your next home.

The costs involved.

Bridging finance.

Property and suburb reports to help guide your purchasing decision.

NY Resolution #3: “I’m going to invest in property in 2019!”

A goodie for 2019! We can help with:

Working with your accountant and/or financial planner on your investment strategy.

Structuring your loan correctly to maximise the tax effectiveness of your investment.

Comparing the loan market to find the right loan products to meet your investment strategy.

Getting loan pre-approval and ensuring your loan application goes smoothly.

Crunching the numbers (for things like your anticipated rental yield or out-of-pocket costs).

Comprehensive suburb and property reports to help you choose the right property.

Accessing equity in your home or from another investment property to use as a deposit.

Offering referrals to reputable property managers and other professionals.

If you have a 2019 property goal, give me a call!

A goal without a plan is just a wish, so let’s start planning and make your goals a reality this year. Please get in touch with us at Element Finance today!