14 Aug 2019

Welcome to the August Newsletter

It’s been an exciting few months in the property world, with plenty of chatter about a potential market rebound. Back-to-back interest rate cuts, looser lending conditions and increased confidence following the May federal election have seen buyers returning to the market. In July, five of the eight capital cities recorded a slight rise in dwelling values, so if you’re a prospective buyer, now might be a good time to dive in and seize the moment.

Interest rate news

At its August meeting, the Reserve Bank of Australia (RBA) decided to leave the official cash rate on hold at 1% pa. The decision follows rate cuts in June and July. The majority of economists believe there will likely be another cut later in the year to 0.75% pa.

Most lenders have adjusted their interest rates to reflect recent cuts by the RBA, but it’s still worth shopping around. Some lenders are passing on bigger discounts than others.

Home value movements

Housing values appear to be stabilising, with five of the eight capital cities recording a modest rise in value in July. In Sydney, prices increased by 0.22%, while Melbourne saw values rise by 0.18% during the month. Values also climbed in Brisbane (0.24%), Hobart (0.27%) and Darwin (0.42%). Perth, Adelaide and Canberra all saw prices fall (by 0.53%, 0.34% and 0.32% respectively). In other news, capital city auction markets recorded the highest preliminary clearance rate in over a year (70.6%) in July.

Property market activity

* Monthly Home Values figures as at July 31, 2019

* Australian auction results, clearance rates and recent sales for the week ending August 4, 2019

Gearing up for a Spring property purchase?

If you’re in the market for a new home or investment property this Spring, we can line you up with the right finance for your needs. Contact us to arrange pre-approval today!

Sincerely,

Mike & the Element Finance Team

You may be surprised to discover that how much you spend on day-to-day living can considerably reduce the amount you are eligible to borrow, even if you are a high-income earner. So, if you’re planning to buy a home, it may be time to cut back on some of life’s little luxuries and set yourself a strict weekly budget. Here’s why.

Why do living expenses matter?

Under the National Consumer Credit Protection Act (NCCP), mortgage brokers and lenders are required to meet ‘responsible lending’ guidelines. These guidelines are designed to ensure a borrower can afford to make the repayments on their loan without suffering ‘substantial hardship’.

That means by law, a mortgage broker or lender must ensure that you have plenty of money left over from your income to repay your loan after you have covered your regular financial commitments. So, we must perform a thorough living expense and income assessment to determine your true financial position before you can apply for a loan.

What are living expenses?

A living expense is anything you spend your money on. It could be a $500 monthly payment for your personal trainer, the $5 coffee you buy every morning on the way to work and everything else in between.

According to a survey by UBank in 2018, 86% of Australians don’t know how much money they spend every month on their living expenses. If you don’t track your purchases, it’s very easy to spend more than you earn without even realising that it’s happening – particularly if you buy everything on your credit card.

Tips for controlling your expenses

The MoneySmart Budget Planner is a great way to see where your money is going. It’s available free from the ASIC MoneySmart website here.

The MoneySmart TrackMySpend app is another handy tool for budgeting and working out where your money is going. It helps you record your weekly household budget, nominate spending limits for different categories of expenses, separate your ‘needs’ from your ‘wants’, and kickstart your savings goals.

How do we perform a living expense assessment?

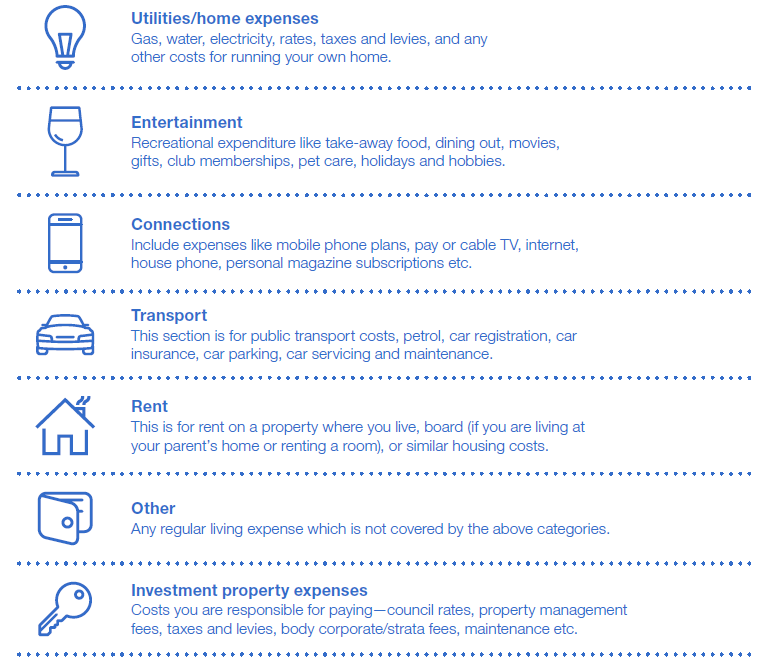

As your mortgage broker, we will provide you with a Needs Analysis Questionnaire to help you figure out your living expenses. It divides them into simple categories, so it’s easy to see that you’ve remembered to include absolutely everything. These categories include:

Frequently asked questions about living expenses

Is rent a living expense? You don’t need to include your rental expenses as part of your living expense assessment if you’re buying a home you intend to occupy.

How about debts? Any debts you have will be included in the liabilities section of your living expense assessment and loan application.

How do we check all of this? We are obliged to ask to see your transaction account and credit card statements, so we can check your spending corresponds to your declared living expenses. We must also ask for proof of income – like copies of pay slips for example.

Cut back on your expenses to increase borrowing power

Whether you’re considering purchasing your first or next home, it’s important to have a solid understanding of your living expenses. Remember, a lender will only give you a loan for an amount that you can afford to repay – cutting back your everyday spending could help to increase this amount and improve your borrowing power.

We will be happy to run through your living expenses and help you find ways to budget and save to increase your borrowing power if you need help. We’ll also prepare your loan application to maximise your chances of getting your loan approved the first time.

15 Jul 2019

Why your broker is your friend for life

How you use your income and available credit can make a huge difference to your lifestyle, so it’s very important to get it right. That means getting reliable, ongoing advice and support from a professional credit advisor you know and trust.

Your mortgage and finance broker can help you with all your big purchases, throughout every stage of your life – from your first home, to an investment property, or even a new car or funding for your small business. Here are some of the benefits of maintaining a long-term relationship with your broker.

Deal with one person who understands you.

When you first meet with us, we take the time to understand your personal financial situation and your goals for the future. That not only means we work with you to help you make a good decision about a loan for what you need right now. It also means we work with you to ensure the decision you make is a good one for your financial future.

Whenever you need to make a big purchase or an important decision about a loan moving forward, your broker will be ready to help. We’ll keep all your paperwork on file and ensure we understand your goals, and that will save you a lot of time and hassle.

By contrast, when you go direct to a bank to get that first loan, they are only concerned about that one loan – not with what happens next. So, every time you need assistance with a new loan, you’re forced to start the whole process from scratch with someone new – which can be very frustrating and time consuming.

Maximise your income and available credit.

If you don’t have the benefit of advice from a trusted professional, how do you know you’re using your income and borrowing power to its full advantage? The last thing you want to do is waste money or miss out on opportunities to secure the home and lifestyle you really want for you and your family.

A long-term relationship with your broker gives you support to maximise your income and improve your financial situation as you progress through your life stages. This knowledge and positive support will help you to achieve the lifestyle you want and make realistic plans to use your income and borrowing power wisely to support your lifestyle in the future.

We’ll even work together with your financial planner, accountant or other professional advisors to help you achieve your financial goals and we won’t charge you for our time.

Support to achieve financial independence.

Banks tend to be strictly transactional. They just provide the service you ask for and you usually only hear from them again when they’ve got another product they want to sell.

By contrast, your broker is here to protect your interests. You can expect to hear from us regularly with any important information that is relevant to you, when the opportunity arises to save money, or to support you in taking the next step in your wealth building journey.

Manage your loans and stay on top of your financial situation.

As you progress through the different stages of your life, your financial situation will change. A common example is when you and your partner have a child and your income temporarily reduces from two salaries to one.

We will always be on hand to help you manage life stage changes and issues. A bank will not necessarily support you personally, which can be worrisome.

Call us for a chat today.

If you’re looking to buy your first home, purchase your next one, invest in property or refinance your home loan just let us know. We can even help with competitive car loans if you want to take advantage of the fantastic EOFY car salesthat are on right now. We love helping you with your lifestyle purchases, as well as achieve your home ownership and wealth building goals, so please get in touch today.

19 Jun 2019

Welcome to the June Newsletter

Winter is here and we can expect our property markets to slow down considerably over the next few months. However, May was a much busier month than expected in many property markets. As a result, home value declines have slowed down, with Melbourne and Sydney showing the smallest month-on-month falls in over a year.

Interest rate news

At its June meeting, the Reserve Bank of Australia (RBA) decided to make a long-awaited cut to the official cash rate, reducing it to 1.25% – the lowest in Australian history. This was the first rate move the RBA has made since August 2016 and it was widely predicted by economists and market analysts. At least one, but possibly two, further cuts to the official cash rate are expected before the end of the year, which would be great news for homeowners and those looking to get a leg up the property ladder while homes are more affordable.

During May, many banks reduced interest rates in anticipation of today’s RBA move. Additionally, the cost of funding has fallen considerably for lenders in the past few months, which has made them more generous about reducing home loan interest rates for both homeowners and new borrowers. There are some very competitive rates available now, particularly on fixed rate loans, so call us if you’d like us to check your interest rate.

Home value movements

During May, falls in home values slowed considerably compared to recent months. Tim Lawless, Head of Research at CoreLogic, predicts that the softening in home values is likely to continue at this reduced rate until the end of 2019.

However, a renewal of confidence in the property market following the Federal Election seems likely, now that Labour’s plans to change negative gearing and capital gains tax for property investors are no longer on the table. The Australian Prudential Regulatory Authority (APRA), has also relaxed its policies on loan serviceability assessments and interest-only lending, which should help to make borrowing easier for property investors and those who may have found it harder to qualify for a home loan over the past year.

Property market activity

After the Federal Election, Autumn property market activity increased considerably, with a larger number of homes sold via private sales in both Melbourne and Sydney than usual. The table below shows property market activity as at June 2, 2019.

If you’re in the market for a bargain, see us about a pre-approval!

Even though winter has arrived, there are still many homes up for sale and it may be a great opportunity for you to negotiate the price on the home you want. It pays to enter negotiations armed with a pre-approval on your home loan, so if you’re in the market to buy a home please call us today to find out more. It’s also the busy time of year for car sales and business equipment purchases, so just let us know if you need help with finance and we’ll help you get it organised quickly before the end of the financial year.

Sincerely,

Mike & the Element Finance Team

26 Apr 2019

How to compare home loans and features

Which home loan is right for you? How can you tell when there’s so many different lenders, loan types and features to choose from? How can you compare loans properly when you’re not sure what you should be comparing?

Finding the right home loan for your situation is a process that can be confusing, particularly for first-timers. In this article, we give you a basic guide for making home loan comparisons and tell you more about the features you may need with your home loan.

Interest rates and comparison rates

Interest rates are one of the factors which determine the cost of your mortgage and how much your repayments will be. Even a small difference in interest rates can make a significant impact on the amount of interest you’ll have to pay over the term of the loan. However, the loan with the lowest interest rate may not necessarily be the cheapest, as there could be additional fees to factor in. This is where the comparison rate comes in.

The comparison rate is an indication of the true cost of a loan, once the interest rate and fees are included. It’s usually expressed as a percentage, which makes it easier for you to compare the real cost of different loan products. When choosing a home loan, it’s important to look at both the comparison rate and the features that come with the loan.

Loan Types

Principal and Interest

This type of home loan requires you to make repayments that cover both the principal (or the amount you borrowed) and the interest at the same time. People buying their own home usually use a principal and interest loan, as you pay down your loan with every repayment until you eventually own the property.

Interest-only

An interest-only loan allows you to only pay the interest you owe on the loan for a fixed period – usually from one-to five years – so the monthly repayment is lower than it would be under a principal and interest loan. At the end of the fixed period, the loan usually reverts to a principal and interest loan, but it is possible to refinance to another interest-only period. People buying an investment property often start off with an interest-only loan because the interest (and therefore the entire repayment) is tax deductible for them. However, they are not considered ideal if you are buying your own home to live in as you will likely end up paying more in interest over the term of the loan and your repayments don’t pay off the original loan amount.

Variable Home Loan

With a variable rate home loan, the amount of interest you pay may go up or down in response to changes in interest rates. This can be a good thing if interest rates go down, as the interest you pay will be less and your repayments will decrease. Another positive is that you can often make extra repayments on a variable home loan, which may help you to pay off your home loan sooner and save some interest over the term of the loan.

Fixed Home Loan

A fixed rate home loan lets you lock in your interest rate for a period (usually 1 to 5 years). The benefit is that you know exactly how much your repayments will be during that time, which can be beneficial if you’re on a tight budget or a fixed income. You’ll also escape any interest rate rises that may happen during the fixed period.

However, if interest rates fall, you won’t be cracking open the bubbly because your home loan interest rate will stay the same and so will your repayments. There may also be restrictions on making additional repayments with a fixed rate home loan.

Split Home Loan

One option that appeals to some homeowners is to fix the interest rate on a portion of their loan and keep the rest variable. This offers the certainty of knowing what your repayments will be on the fixed part of the loan, while you can make extra repayments and enjoy any interest rate drops on the variable part of the loan. It’s a way to get the best of both worlds!

Loan Features

Offset Account

An offset account is a transaction account that’s attached to your home loan. It can save you money on the interest on your home loan and help you pay off your loan sooner because the money in your transaction account is offset daily against your loan balance, and you only pay interest on the difference. For example, if you owe $300,000 on your home loan and there’s $50,000 in your offset account, you’ll only pay interest on $250,000.

Redraw Facility

A redraw facility allows you to make extra repayments on your home loan and then take out the extra repayments you’ve made later if you need to use the money for a different purpose.

What’s right for you?

The right home loan choice is different for everyone. It all depends on your personal financial circumstances and goals. We’re here to help you decide what is right for you and will make recommendations based on what you tell us about your situation and what you want to achieve. Then we’ll compare the choices from the different lenders and offer you a selection of cost-effective options.

Don’t wait to find out what’s right for you. Call us today for a chat about your plans.