23 Sep 2019

Welcome to our September Newsletter

Spring has arrived and we are supercharged for a bumper season in the property world. Dwelling values have been creeping up in many markets and auction clearance rates have been higher recently too. Interest rate reductions and changed lending rules have fuelled increased buyer activity, though stock volumes remain low. Overall, the housing recovery looks set to continue.

Interest rate news

At its September meeting, the Reserve Bank of Australia (RBA) decided to leave the official cash rate on hold at 1% pa. The move follows rate cuts in June and July.

While this month’s decision was widely anticipated, economists say there could be more cuts by the end of the year, potentially starting in October. Recently we’ve seen some lenders slash fixed interest rates on both owner-occupier and investor loans.

Given rates are on the move, now is the time to review your finance. It may even be worth considering fixing your home loan – speak to us about your options!

Home value movements

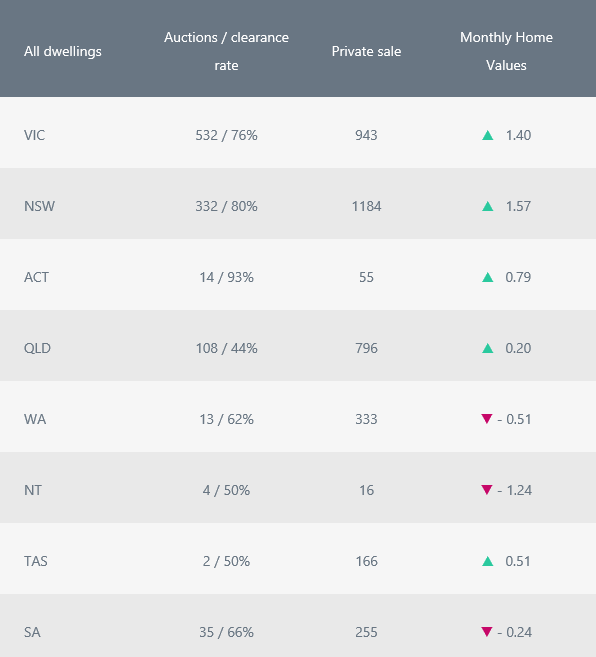

Property prices are continuing to rise, up 1.03% across the combined 5 capital cities in August. Prices in Sydney and Melbourne continue to trend higher. Sydney recorded a month-on-month change of 1.57%, while Melbourne’s property values grew by 1.40%. In Canberra, prices increased by 0.79%, while in Hobart they rose by 0.51%. Brisbane saw modest growth (0.2%), while Perth and Adelaide experienced falls of 0.51% and 0.24% respectively.

In recent weeks, we’ve seen auction clearance rates soar in many markets. In fact, auctions across Australia’s capital cities reached a two-year high in August.

Property market activity

Ready for a spring property purchase?

If you’re considering buying this spring, speak to us about organising your finance. Given that stock volumes are low, there’s bound to be strong competition amongst buyers, but having pre-approval in place may give you a competitive edge. Get in touch today so we can get it sorted!

04 Sep 2019

Four signs it may be time to refinance

Do you know what happened after the Reserve Bank cut the cash rate in June? Tens of thousands of Aussies took the Treasurer’s advice to “shop around and get the best possible deal”. Mortgage brokers around the country have recorded spikes in their home loan, investment loan and refinance borrower enquiries following the announcement.

The moral of the story? Now is the time to review your home loan. Here are four signs you may be overdue for a check-up.

You’ve been with the same lender forever

Interest rates are at historic lows and competition between lenders is high. That means there are plenty of red-hot deals out there, particularly given the recent cash rate cuts.

If you’ve been with the same lender for years, chances are you’re probably missing out on a better deal elsewhere.

You have no idea what a redraw facility or offset account is

Most home loans nowadays come with money-saving features like offset accounts and redraw facilities. These tools allow you to save in interest and potentially pay off your loan sooner.

How they work

Offset accounts

With this set up, a transaction account is linked to your mortgage. Any money deposited is offset against your loan balance, reducing your interest payable. Example: you owe the bank $400,000 and you have $50,000 in the offset account. Interest will only be calculated on $350,000.

Redraw facility

With this loan feature, you can make extra repayments on your mortgage and save on interest. Best of all, you can still access the funds in future should you need them.

Your personal circumstances have changed

What’s changed since you took out your mortgage? Are you earning more money? Have your living expenses changed? Do you have different financial goals?

All of these elements need to be taken into consideration when choosing the right home loan for your needs.

You’re drowning in debt payments

If you’re struggling to cover multiple debt repayments, debt consolidation could be the answer. This strategy involves refinancing your mortgage and using some of your equity to pay off the other debt.

The benefits are:

- Home loan interest rates are lower than other types of credit

- You’ll only have one repayment to meet

- You can spread the repayments out, so that they’re more affordable

- You may be able to make additional repayments and knock off your debt sooner.

While debt consolidation is not right for everyone (in some instances, you may end up paying more in interest over the course of the loan), it’s at least worth investigating.

Like to know more?

If the alarm bells are ringing, we can review your home loan and outline whether it’s still right for you. You may be better off with another loan that ties in with your current financial situation and goals. Please reach out – you have nothing to lose and everything to gain.

The busy Spring property season is just around the corner and you know what that means? Whether you’re planning to buy or sell, NOW is the time to start getting organised. Here’s how.

Tips if you’re planning to BUY this Spring:

Get your finance sorted pronto

There’s no point starting the property hunt until you know how much you can borrow. Talk to us and we’ll explain your borrowing power.

If you haven’t already done so, it’s also a good idea to get pre-approved for finance now, so that you don’t miss out on your dream home once you find it. For most lenders, pre-approvals last 3-6 months.

Do your research

Whether you’re a first home buyer or you’ve been around the block, it’s important to do your homework.

- Narrow down the suburbs you’re interested in and research the market value of your desired property type

- Check government websites for projects that may influence the capital growth potential

- Consider the zoning and whether upcoming developments could affect supply and demand

- Check out recent comparable sales on websites like realestate.com.au

- Get to know local real estate agents now, so that they keep you in the loop about new listings during Spring

- Ask us for a free suburb report with all the key info you’ll need.

Attend several auctions before you actually bid

Bidding at auction can be extremely daunting, particularly with the knowledge that there’s no cooling off period. You’ll want to feel confident about the process before going in guns blazing.

Over the coming weeks, make time to attend several auctions to get a feel for how they unfold. Even if you’ve bought at auction before, it’s a good idea to suss out the market in advance.

Tips if you’re planning to SELL this Spring:

Declutter

That’s right, it’s time to channel your inner Marie Kondo (she’s a tidying expert, if you haven’t heard of her). You may be thinking, ‘it’s only August, I’ll have time for that later,’ but it’s important not to underestimate how long the decluttering process can take!

Decluttering can make a world of difference to prospective buyers. It allows them to see the space more clearly and imagine themselves living in your home. In simple terms, space sells.

With that in mind, ditch what you don’t need and consider putting the majority of your belongings into storage.

Clean meticulously

Time to give your home a thorough clean. You’ll want your property looking its absolute best for when the inspections begin.

If there are any repairs or maintenance jobs you’ve been putting off over the Winter, now is the time to address them.

Consider renovating

Want to drive up the sales price? Why not renovate this month and add value to your property?

Most experts recommend the top priorities when renovating for profit should be the kitchen and bathroom(s). If you need finance for these kinds of big-ticket renovations, we can help.

However, even making small cosmetic enhancements, like applying a fresh coat of paint or putting up new blinds, could result in a heftier price tag.

Sort out your finance for your next property purchase

Already found your next home? You may need bridging finance to tide you over until settlement is finalised on your old property.

So, what’s on your to-do list this month? Remember, whether you’re buying or selling this Spring, now is the time to start planning and preparing. Speak to us for all your finance needs today!

Rentvesting has become increasingly popular in recent times. Last year, research from the Property Investment Professionals of Australia (PIPA) found that one third of first-time buyers opted to become ‘rentvestors’, rather than homeowners.

Here’s what you need to know before deciding whether rentvesting is right for you. But first, let’s look at an age-old question.

To rent or buy?

If you’re wondering whether it’s cheaper to rent or buy, the answer depends on where you buy and your individual financial situation.

Domain Group compared weekly mortgage repayments on a median sale price to median rent for both houses and units in the year to April. The research found that in many capital city suburbs, rents were higher than mortgages (find out where it’s cheaper to buy a property than rent).

But what if you didn’t have to choose between renting and buying. What if you could have the best of both worlds?

What is rentvesting

Rentvesting is where you rent where you want to live and buy where you can afford. Simple.

Pros

A leg up on the property ladder

If, like most first-time buyers, you can’t afford your dream home straight away, rentvesting gives you options. It allows you to get started in the property market with a smaller deposit and work towards buying the home you want, or to build your investment portfolio.

Lifestyle perks

Want to live in a trendy neighbourhood that’s out of your price range? With rentvesting, you can. Live the lifestyle you want, and invest elsewhere.

Flexibility

Renting gives you increased flexibility to move around if your circumstances change.

Tax benefits

What’s really great about owning an investment property are the tax perks. Most of the property expenses can be offset against your income.

Cons

No FHOG

If you decide to buy an investment property rather than a home, you won’t be entitled to the First Home Owner Grant and stamp duty exemptions or concessions. These are for first time owner-occupiers.

Added responsibility

Being a renter and a landlord at the same time means you’ll have multiple expenses to cover. In addition to paying your rent, you’ll have costs including council rates, body corporate (if applicable), property management fees, maintenance, other running costs, and of course, your mortgage repayments. Keep in mind that if your investment is tenanted, the rental return may cover some, if not all, of these expenses.

You won’t own your home

Renting means you won’t be able to make the property your own. You also won’t have control over how long you can stay. Leases usually tend to be 6 or 12 months, so you may end up having to move regularly.

Capital Gains Tax

If your investment goes up in value, you may be subject to Capital Gains Tax when you decide to sell.

Steps for purchasing your first investment property

Step 1: Talk to us about your borrowing power and get pre-approval on your finance

Step 2: Formulate your investment strategy (it’s a good idea to talk to a financial planner or accountant)

Step 3: Create a purchasing budget, factoring in all the costs associated with owning an investment property

Step 4: Do your research (for things like capital growth potential and rental yield)

Step 5: Once you find a property, organise building and pest inspections

Step 6: Get us to finalise your investment loan.

Like to know more?

If you think rentvesting is right for you, we can help you explore your finance options. We’ll hook you up with a competitive investment loan that’s right for your needs. Please get in touch.

14 Aug 2019

Welcome to the August Newsletter

It’s been an exciting few months in the property world, with plenty of chatter about a potential market rebound. Back-to-back interest rate cuts, looser lending conditions and increased confidence following the May federal election have seen buyers returning to the market. In July, five of the eight capital cities recorded a slight rise in dwelling values, so if you’re a prospective buyer, now might be a good time to dive in and seize the moment.

Interest rate news

At its August meeting, the Reserve Bank of Australia (RBA) decided to leave the official cash rate on hold at 1% pa. The decision follows rate cuts in June and July. The majority of economists believe there will likely be another cut later in the year to 0.75% pa.

Most lenders have adjusted their interest rates to reflect recent cuts by the RBA, but it’s still worth shopping around. Some lenders are passing on bigger discounts than others.

Home value movements

Housing values appear to be stabilising, with five of the eight capital cities recording a modest rise in value in July. In Sydney, prices increased by 0.22%, while Melbourne saw values rise by 0.18% during the month. Values also climbed in Brisbane (0.24%), Hobart (0.27%) and Darwin (0.42%). Perth, Adelaide and Canberra all saw prices fall (by 0.53%, 0.34% and 0.32% respectively). In other news, capital city auction markets recorded the highest preliminary clearance rate in over a year (70.6%) in July.

Property market activity

* Monthly Home Values figures as at July 31, 2019

* Australian auction results, clearance rates and recent sales for the week ending August 4, 2019

Gearing up for a Spring property purchase?

If you’re in the market for a new home or investment property this Spring, we can line you up with the right finance for your needs. Contact us to arrange pre-approval today!

Sincerely,

Mike & the Element Finance Team