You may be surprised to discover that how much you spend on day-to-day living can considerably reduce the amount you are eligible to borrow, even if you are a high-income earner. So, if you’re planning to buy a home, it may be time to cut back on some of life’s little luxuries and set yourself a strict weekly budget. Here’s why.

Why do living expenses matter?

Under the National Consumer Credit Protection Act (NCCP), mortgage brokers and lenders are required to meet ‘responsible lending’ guidelines. These guidelines are designed to ensure a borrower can afford to make the repayments on their loan without suffering ‘substantial hardship’.

That means by law, a mortgage broker or lender must ensure that you have plenty of money left over from your income to repay your loan after you have covered your regular financial commitments. So, we must perform a thorough living expense and income assessment to determine your true financial position before you can apply for a loan.

What are living expenses?

A living expense is anything you spend your money on. It could be a $500 monthly payment for your personal trainer, the $5 coffee you buy every morning on the way to work and everything else in between.

According to a survey by UBank in 2018, 86% of Australians don’t know how much money they spend every month on their living expenses. If you don’t track your purchases, it’s very easy to spend more than you earn without even realising that it’s happening – particularly if you buy everything on your credit card.

Tips for controlling your expenses

The MoneySmart Budget Planner is a great way to see where your money is going. It’s available free from the ASIC MoneySmart website here.

The MoneySmart TrackMySpend app is another handy tool for budgeting and working out where your money is going. It helps you record your weekly household budget, nominate spending limits for different categories of expenses, separate your ‘needs’ from your ‘wants’, and kickstart your savings goals.

How do we perform a living expense assessment?

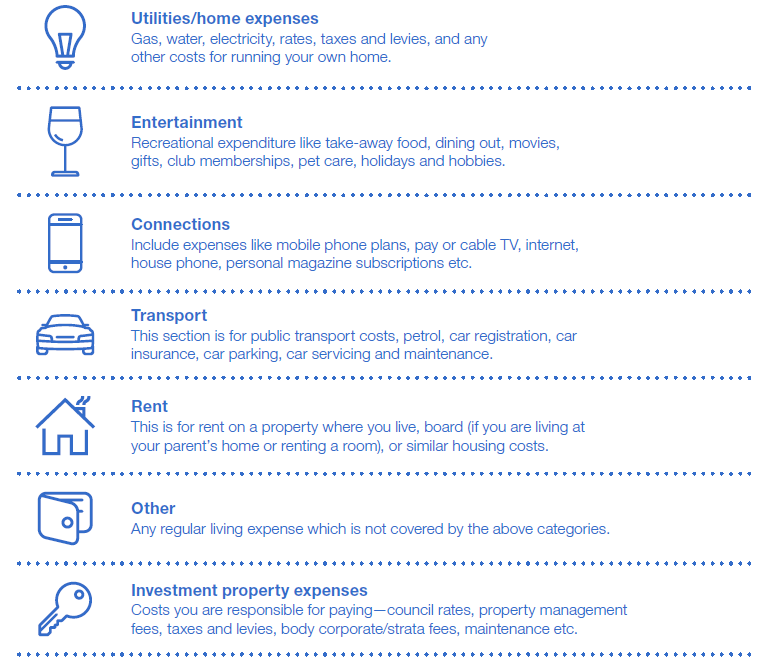

As your mortgage broker, we will provide you with a Needs Analysis Questionnaire to help you figure out your living expenses. It divides them into simple categories, so it’s easy to see that you’ve remembered to include absolutely everything. These categories include:

Frequently asked questions about living expenses

Is rent a living expense? You don’t need to include your rental expenses as part of your living expense assessment if you’re buying a home you intend to occupy.

How about debts? Any debts you have will be included in the liabilities section of your living expense assessment and loan application.

How do we check all of this? We are obliged to ask to see your transaction account and credit card statements, so we can check your spending corresponds to your declared living expenses. We must also ask for proof of income – like copies of pay slips for example.

Cut back on your expenses to increase borrowing power

Whether you’re considering purchasing your first or next home, it’s important to have a solid understanding of your living expenses. Remember, a lender will only give you a loan for an amount that you can afford to repay – cutting back your everyday spending could help to increase this amount and improve your borrowing power.

We will be happy to run through your living expenses and help you find ways to budget and save to increase your borrowing power if you need help. We’ll also prepare your loan application to maximise your chances of getting your loan approved the first time.

31 Jul 2019

Tips to build your own home

Here’s an overview of what’s involved if you’re considering building a new home for the first time.

What’s your budget?

The first step to building a home is deciding what you can afford to spend. When buying a home that’s already built, determining how much money you need is quite straightforward. However, it’s not so simple when building. Once you’ve finalised your budget you’ll know if you need finance. We can help determine your borrowing capacity to get your build underway.

Select a home building option

When it comes to building your own home, there are several ways to go about it. You can select a house and land package, or you can work with a designer and custom-build your property on your own land. Some people choose kit homes or modular homes as they are faster to construct – most of the components are prefabricated and delivered to the site to be assembled – but talk to us before you choose this option as not all lenders are enthusiastic about this type of building project.

There are plenty of useful websites where you can find estimates of how much it costs to build the kind of home you want. Remember – you can explore these options more effectively once you know exactly how much you can spend.

Find the right block of land

Some people buy their land before choosing the home they want to build. Others choose the home design first. Either way, make sure the home design will work on the block of land you choose. A site that has a steep slope or an unusual shape, for example, may be difficult to build on. It’s a good idea to seek professional advice from a reliable builder to make sure your land and home design are compatible.

Choosing a builder

It’s important to do plenty of research when selecting your builder. You could ask friends and family for recommendations or go online to research builders. Be sure to check out other homes the builder has constructed. Also, check in with the Master Builders’ Association to make sure your preferred choices are legitimate and have received no major complaints.

It’s a good idea to get quotes from several different builders, complete with detailed plans, price breakdowns and a timeline for completion. You should also have your solicitor or conveyancer check the documentation before you commit.

Secure finance

A construction loan is the most popular option if you are building your own home. Construction loans are different from regular home loans. The lender releases portions of the loan, or progress draws, throughout the construction process. These are only paid once an inspection of the build has been completed at certain stages. This helps to keep your project on schedule and protect both you and the lender from less than honest builders.

Usually you pay interest-only during the construction, then repayments convert to principal and interest upon completion.

There’s nothing more exciting than watching your home grow from the ground up. We’d love to help you build your dream home, so please get in touch.

In Australia, it’s possible for just about anyone with a deposit to invest in property, whether you are a low-income earner on a tight budget, or a well-off with loads of disposable income. Interest rates are very low at the moment and home prices are more affordable than they’ve been for a while. So, if you’ve been thinking about property investment, it may be a good time to get started.

Rentvestors

Rentvestors are often motivated by a desire to maintain their current lifestyle, while still wanting to get on the property ladder. The solution? To rent where they want to live and invest in more affordable suburbs elsewhere.

This type of investment strategy can help you to grow a deposit to enable you to buy a home where you’d prefer to live later, but talk to a professional financial planner to ensure it will work for you. Capital growth is an important factor in Rentvesting, so it’s also important to research your property investment carefully and locate an up-and-coming suburb where this is more likely to happen quickly.

‘Mum and Dad’ investors

This is a common way of describing a conservative type of investor. ‘Mum and Dad’ property investors will typically have paid down their family home loan and be ready to access the equity to build more wealth for the future. They’ll often be growing their portfolio slowly and want to have only one or two investment properties in addition to the family home.

Each investor’s strategy depends on their goals and how comfortable they are with risk. If you are a conservative investor, you may opt for ‘set and forget properties’ that are easy to maintain and likely to deliver moderate long-term capital growth. This approach helps to protect your capital while making “extra” money.

Short-term investors (property flippers)

Buying, renovating and selling quickly is the name of the game for flippers. The idea is to buy a property in need of some TLC, but no major structural work. This takes careful research and it pays to have a team of builders and property inspectors to help you make the right property purchasing choices.

Property flippers manufacture capital growth by renovating. For this type of strategy to work, you need to be willing to invest considerable time and energy into the project and have a very firm grasp of both your budget and building costs.

It’s important to note that when property prices are falling, flipping can be a very risky business. If you fail to get your budget right, it could be very easy to end up with a property that’s worth less than you spent on buying it and renovating it.

Investors who do it as a business (long-term)

This type of property investor takes a professional approach and work as though they are operating a business. They often have a significant, diversified portfolio that includes both residential and commercial properties, and plan to continually purchase more properties.

Sophisticated investors are up to speed with things like value movements in the property market and maximising their tax advantages. They usually seek professional advice from a qualified accountant to support and inform their activities and decisions.

Investors who do it as a business buy, when home values fall rather than allow market variations to keep them up at night. They are usually careful to set up financial buffers to protect themselves throughout the peaks and troughs of a property cycle.

Get a professional broker on your team

No matter what approach you take to property investing, the right finance solution is critical to your success and can potentially make a big difference to the profit you make. We’re here to ensure your mortgage and loan structure is suitable for your investment strategy, personal financial circumstances, needs and goals. Feel free get in touch to find out more.

17 Jul 2019

Welcome to the July Newsletter

Great news for homeowners and property buyers this month. Home loan interest rates have fallen again. If you’re in the market for a home or want to invest in property, now is a good time get pre-approval on a competitive home loan.

Interest rate news

At its July meeting, the Reserve Bank of Australia (RBA) decided to cut the official cash rate for the second month in a row, bringing it to just 1% p.a. – a new historical low. Many analysts agree there will likely be at least one more RBA rate cut this year, which would bring the official cash rate to just 0.75% p.a. and some are predicting it may even fall as low as 0.5% p.a.

Most lenders passed on the RBA rate cut to home owners last month, bringing interest rates on many standard variable rate home loans to just 3.6% p.a. or lower.

Home value movements

During June, Melbourne and Sydney both recorded slight home value increases for the first time since 2017 and Hobart also showed an increase. However, national property values dipped by 0.2% on average across the month, and there were sharp falls in Brisbane, Adelaide, Perth and Canberra, which could be an indicator that the property market correction is not quite over yet.

It seems likely that the re-entry of property investors to the market was responsible for the rise in home values in our biggest markets, last month. Tim Lawless, a market analyst from CoreLogic, said that “the removal of uncertainty surrounding changes to negative gearing and capital gains tax discounts [following the Federal Election] has boosted confidence.”

Property market activity

If you’re in the market for a bargain, see us about a pre-approval!

Even though winter has arrived, there are still many homes up for sale and it may be a great opportunity to negotiate on price. It pays to enter negotiations armed with a pre-approval on your home loan. If you’re in the market give us a call, we’d be happy to help.

Sincerely,

Mike & the Element Finance Team

If you’re looking to rent out or sell your home, identifying the right market for your property and making it appeal to them, will help you to maximise your profits. So how do you go about it? Use these tips for identifying the most profitable target market for your property and ways to spruce it up to increase its appeal.

Find out who wants to live in your area

The first step is to research who is currently living in the area and who may want to move there in future. Is the area popular with families, or does it appeal more to young professionals or retirees?

A simple way to find out is to touch base with a few real estate agents, to see what kind of customers they have looking for property in your area. Real estate agents often have waiting lists of buyers and renters, so it can be useful to get to know them and form a good working relationship with them if you want to buy or rent out property.

Investigate what kind of properties are in high demand

Next, find out which properties are moving fastest in your area. Are they apartments, two or three-bedroom homes, or new developments? Is the demand highest from high or low budget purchasers and renters?

Finding out the kind of customers moving into your area will also fuel ideas about how to make your property more appealing, so you can maximise your sale price or rental return

An easy way to find out is to browse local real estate agent websites to check prices and how long similar properties to yours stay on the market. Again, if you have a good relationship with your local real estate agents, you can simply give them a call and ask them.

Consider making some changes

Once you’ve discovered the kind of buyers or renters who want a property in your area, you can focus on making yours more appealing to them. Renovations can add value to a property in more ways than one!

If you decide to do some renovations, be sure to talk to us about finance before you start. Here are some ideas of the kind of features that may be popular with different demographics. It should be noted that these days, people prefer clean, recently renovated bathrooms and kitchens. Most of the ideas below can be improved or added cost-effectively and can make a big difference to a sale price or rental return.

| Demographic | Features they may desire |

| Families | Easy clean flooringGood cooking facilities/dishwasher Plenty of storage/laundry space Child-friendly yard Secure outdoor facilities for pets Sizeable garage |

| Independent young people (under 35) | Trendy décorWi-fi and the latest gadgets Dishwasher Low-maintenance courtyard or garden Renovated bathroom/kitchen Off-street parking |

| Mature independent (over 35) | Energy-efficient featuresEasy clean décor/flooring Plenty of storage spaces Pet amenities/garden Security features Off-street parking |

| Elderly couples (downsizers) | Entertaining areas for family and friendsSecurity features Low-maintenance property Pet amenities |

Don’t over capitialise!

When renovating, it’s important to budget carefully and spend wisely to ensure you don’t spend too much and you get the outcome you’re looking for.

For example, if you purchase a house for $400,000 and spend $100,000 doing it up, you’ll want to ensure the end value of the property is worth more than $500,000. You’ll also want to ensure the renovations make the property much easier to rent out or sell – for example, there’s no point putting in a swimming pool if renters and buyers in your area are not interested in having one.

Get a professional on your team.

If you need property market data about prices or rental returns, just ask us. We often have great information to share or can point you in the right direction to find what you need to make informed decisions.

Targeting the right market is often the key to maximising your returns and profits. And if you’d like to renovate, we can help you create a budget and explore your finance options. Please get in touch today if you’d like to find out more.